You will also input information about the products and or services you sell. Getting started with small business accounting software usually takes between 15 minutes to several hours, depending on how long you’ve been in business, how organized your finances are currently, and the complexity of your business.Īfter the initial setup of your account, you will need to provide information about your company structure, customers, and vendors.

#LOW COST ACCOUNTING SOFTWARE FOR SMALL BUSINESS MANUAL#

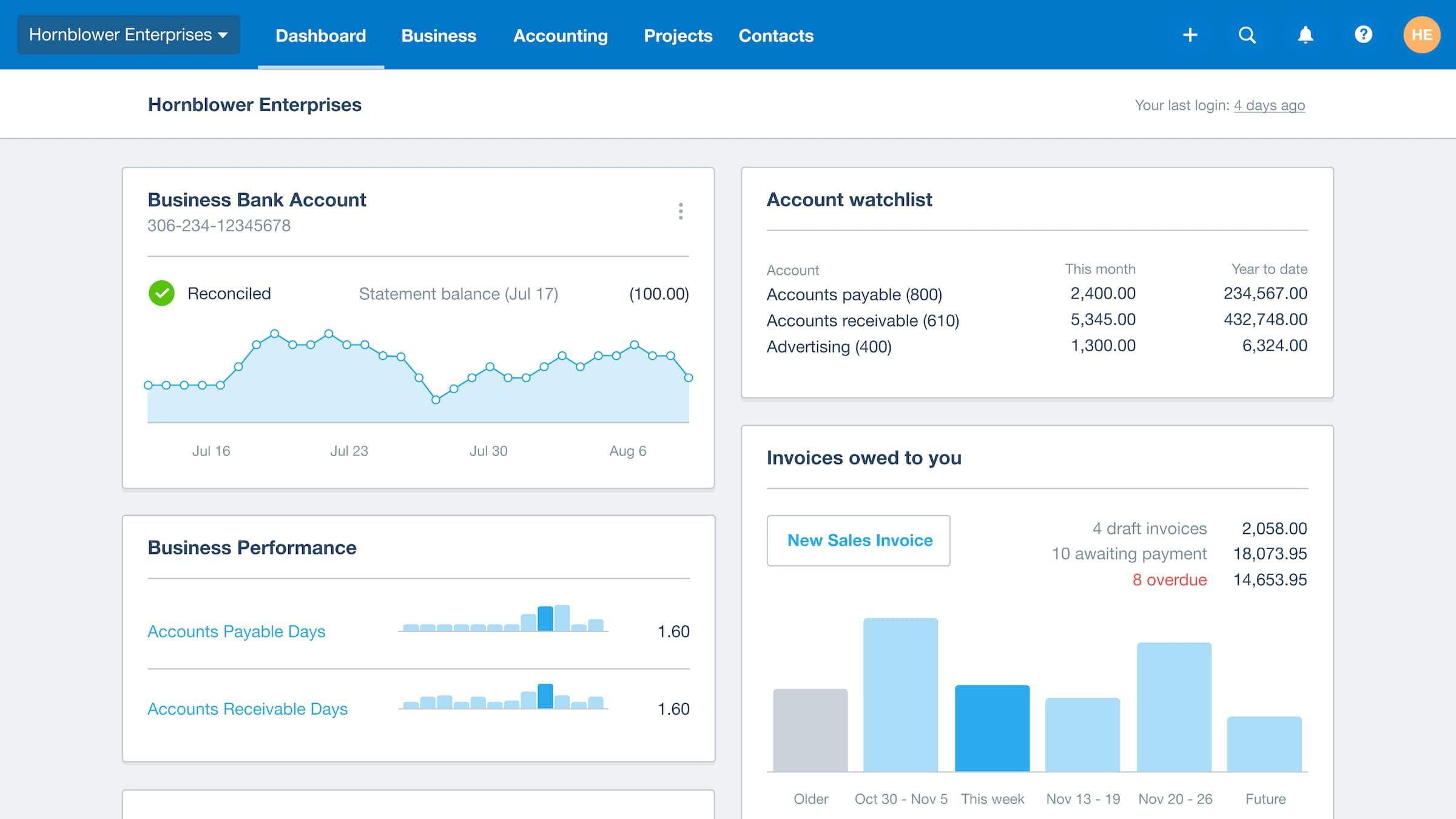

Small business accounting software effectively reduces the amount of time you spend on manual tracking of income and expenses by allowing business owners to automate workflows and sync financial accounts. What Does Accounting Software for a Small Business Do? Generally, small businesses do not require any software customizations, and “out of the box” accounting software provides all the features and tools you need, as well as some you may not have considered. There are various accounting software tools available for small businesses, providing different price points and capabilities. Why is this important? When you have a deeper understanding of and control of your company’s finances, you are better equipped to make good decisions and plan for the future. This provides a clear picture of your company’s profitability and prepares you for tax season. However, your accounting software should also provide insights into your business and give you an accurate overview of how your business is performing. Small business owners need accounting software to help them track accounts receivable and accounts payable.

Predict whether or not your business will hit its budget targets.Determine your business’s profitability,.This bare-bones fix for accounts receivable (income) and accounts payable (expenses) tracking does not provide the functionality necessary to: Why Do Small Businesses Need Accounting Software ?īookkeeping for your small business is complicated and time-consuming, especially if you track your income and expenses on a spreadsheet. While there are many options for your company’s accounting software needs, we’ve rounded up 11 of the most effective selections to keep your small business in the black. When choosing a software solution, select software that utilizes double-entry accounting, provides live support, generates reports, and integrates easily with the business apps your company already uses. The accounting software you choose should make it simple to keep detailed and accurate books for your business. If you run a small business, keeping a close eye on your finances is critical for your success.Īccounting software is an important tool for your small businesses. Amazon FBA Inventory Management – Fulfillment by Amazon (FBA) software features, Better Seller Performance Ratings, FBA Shipping and FBA reporting features.Training & Support – SkuVault training, On-boarding packages, Customer Service and Support information.Datacoach – Deep Insights into your warehouse and inventory, early indicators for warehouse problems, metrics to benchmark performance and labor optimization.Inventory Management Reporting – Advanced analytics, Replenishment Report, Just in Time (JIT), Drop Shippings, Re-Ordering, Out of Stock, and Purchase Order Reporting Features.

Pick, Pack, Ship – Inventory picking, Hyper Picking, Interactive wave picking, Quality Control, Holds, Daily Deals and Flash Sales, Print-to-order, and shipping features.eCommerce Inventory Management – Barcoding, Cycle Counting, Real-time data syncs, and Quantity buffers features.Catalog Features – Detailed product listings, Kitting and Bundling, Assembled Products, Lots, FEFO, FIFO, and Serialization features.Supply Chain – Manage suppliers, Inventory Forecasting, Advanced Purchase Order Features, and PO Receiving features.

0 kommentar(er)

0 kommentar(er)